The New CRM

With economic pressures mounting, it has never been more critical to retain customers and capture 1st party data - Web3 can help!

The New CRM

With economic pressures mounting, it has never been more critical to retain customers and capture 1st party data.

CRM ( customer relationship management ) has been around for ages, but new forms of loyalty are emerging, leveraging blockchain technologies that prepare for the next wave of customer relationships.

We can all remember a time when the Rolodex was our most prized and sophisticated way to organize information - and one of our favourite portmanteaus; the term “Rolodex was coined by the Danish inventor by combining the two words “rolling” and “index”. In the 1980s, databases made it possible to structure data, and database marketing was born. Early statisticians (decision analytics) were hired to help marketing professionals understand to whom they should send marketing materials and which customers are not worth the investment, mainly through brochures and direct mail. We primarily dealt with first-party data and an occasional data overlay - typically from suppliers like Experian and Mosaic. Consumer banking and insurance were some of the most sophisticated marketing-driven industries before the Internet became mainstream.

At some point, customer relationship management became customer relationship marketing - this is when the natural delineation between consumer CRM and B2B CRM began. As consumer experts, we will focus on direct-to-consumer-oriented CRM in this article. Business-to-business and operational CRM are entirely different, with some overlap between B2B and B2C in tooling and third-party data sources.

Web 1 and 2 catalysed more advanced database marketing leveraging email addresses and online behavioural data from third parties. It was Tom Siebel (and later Siebel systems) that pioneered the first automation of data - some claim he, along with renowned marketing expert Jagdish N. Seth from the Gartner Group coined the term “CRM”. By 2007 we could merge first-party and third-party data, a perfect marketing cocktail. In our last article, we illustrated the productisation of customer data through the Facebook lens. For anyone less familiar with CRM, we can count on Salesforce to give us a quick overview of the CRM industry journey -

The late 2000s was also referred to as the “Hashtag Age.” Businesses started using social media channels, such as Facebook and Twitter, as a way to manage relationships with customers. Companies started using social media in their CRM strategy, shifting from transactional to interactive client relationship management. Toward the end of the decade, some of the CRM providers we know today were founded, such as Insightly (2009), Pipedrive (2010), and Freshsales (2010).

What is the new CRM?

A few external forces are increasing CRM's priority in a business strategy. Privacy, tech stack enhancements, Web3 and platform economics. CRM tools are getting more sophisticated coupling the CDP and DMP to seamlessly connect to an ESP.

We are back to leading with first-party data due to GDPR in the EU and Apple’s crackdown on personal data access via mobile application opt-in and Safari dropping cookies. Our ability to leverage social CRM has also changed - we need to know who our customers are and capture their data with less friction than we had before. It feels like direct mail and catalogues are sexy again - they might be. CRM is being integrated into businesses’ overall customer experience strategy. Today, we can accurately predict how customers interact with brands and customise messages to reflect their behaviours and preferences.

Google cookie changes - they can’t delay their cookie decision forever. In 2023, there will be no more cookies left for marketing professionals to leverage. Like Facebook, Google will have a solution to navigate this and will likely discover that solution is not as elegant. The perceived value of paid search and Google display network will decrease. When Facebook lost a significant percentage of their customer tracking after Apple changed their privacy rules, Facebook created “signals” to help advertisers understand performance based on a new tracking method - not sure those signals are working based on the demise of the D2C lifestyle industry.

**E&Y produced a helpful infographic on navigating a cookie-less world, confirming our point regarding first-party data as the essential tool in a marketing playbook. There will be many DMPs adding this to their tooling this year if they haven’t already.

The crackdown on data access is leaving a gap in insights. Brands are investing in data overlays more than ever and using directional information from social graphs and more frequent brand insight tracking to understand their customers better. New data suppliers are emerging - telecommunications companies, open banking data and affiliate marketing solutions.

Cryptocurrency - an open network of blockchains where millions transact, collect and engage with Web3 brands is a new data source very few brands have tapped into. In addition to the data source, blockchain applications are emerging as new CRM platforms that can be used in isolation or conjunction with Web2 marketing tech stacks. All of the data changes mentioned in points one and two more or less pave the way for a less centralized web - otherwise known as the semantic web. The term “Semantic Web” refers to W3C's vision of the Web of linked data. Semantic Web technologies enable people to create data stores on the Web, build vocabularies, and write rules for handling data. Like the Internet, the Semantic Web will be as decentralized as possible. Such Web-like systems render much excitement at every level, from major corporations to individual users, and give benefits that are hard or impossible to predict in advance.

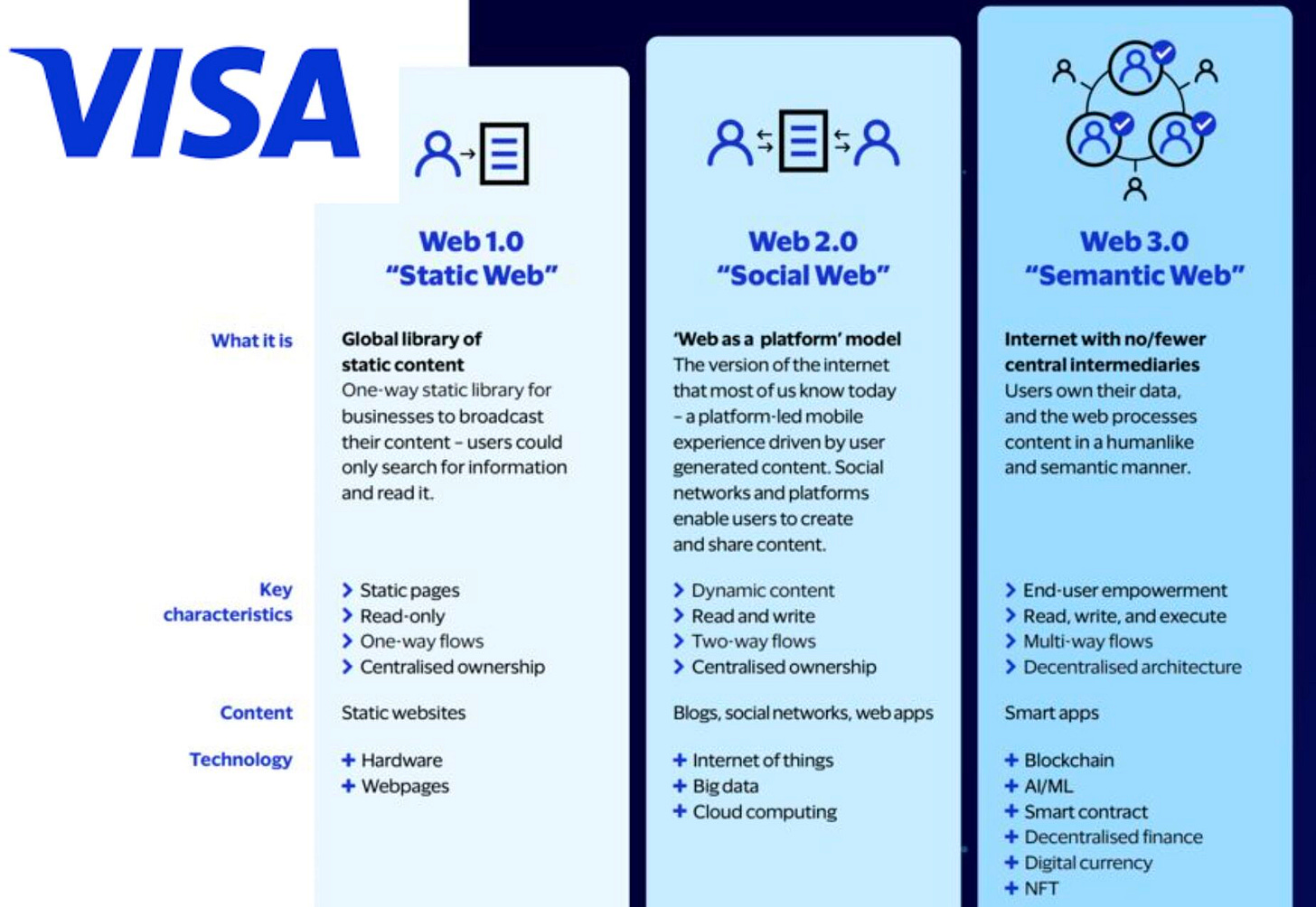

We like how Visa breaks this down - it feels like an evolution from the usual Web 1-3 overview many of us have seen.

How does the “new CRM” come together - we made a few diagrams to illustrate the impact Web3 has on CRM and how a marketing team sees the evolution from Web2 to Web3 -

As marketing professionals, everything starts with customer data. We spend an absurd amount of time dealing with customer data and the tools associated with collecting, storing and analyzing that data. Rather than start with the tools - let’s look at how that data and technologies come together.

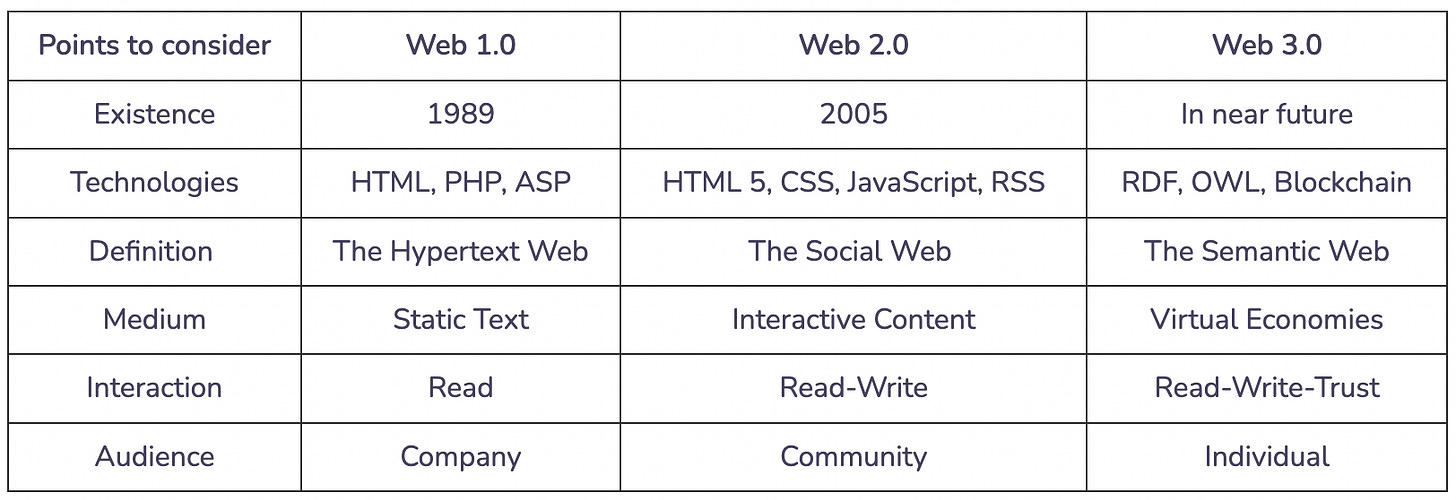

Web3 also encourages businesses to change their audience definitions.

However, unlike Web2, where an email address is just that - a place to receive emails. A crypto wallet is a place to receive airdrops, a payment tool, promotional and product updates and an authentication point and an insights source. This could change if centralized services take over Web3 - and all wallets are custodial - a wallet in which the private keys are held by a third party having complete control over your funds while you only have to send or receive payments.

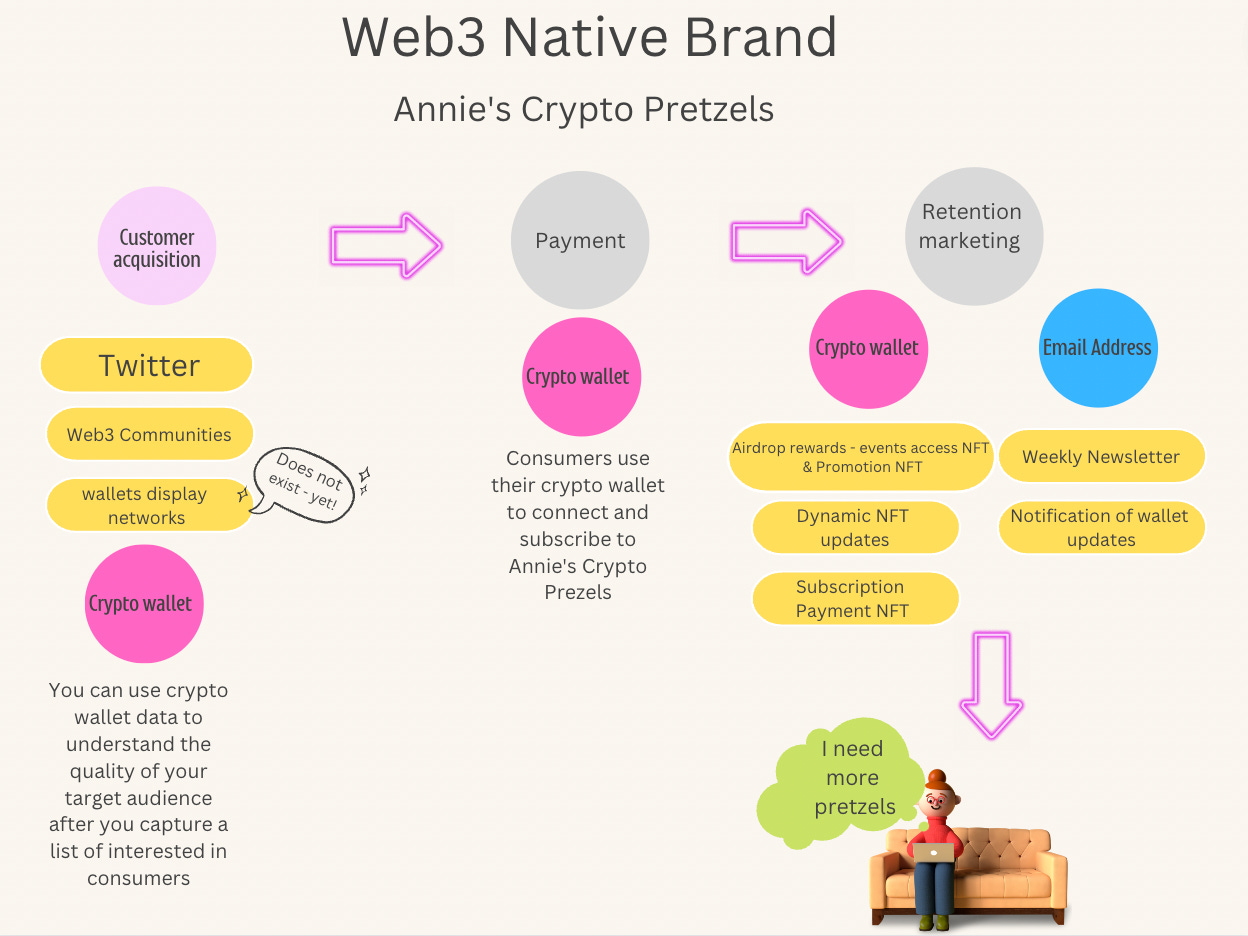

A web2 brand will utilize crypto wallet information and connect to crypto wallets differently from a web3 brand. Is this scenario - this is how a Web3 native brand engages with a customer -

So, once a crypto wallet is in the mix - how does that change things? It depends on the business profile. For native Web3 businesses - the crypto wallet and an email address are typically all that business has. Consumers prefer to use their wallets to engage with that organization. A web3 brand understands the full Web3 tech stack.

NB - We know small wallet display networks exist, but they are not robust enough to rely on yet.

For a Web2 brand that is starting to onboard Web3 customers - the complexity increases as they manage customer relationships through many legacy channels. However, a web2 brand probably only understands the access layer for Web3. This is what most traditional marketing professionals will learn about - the wallet, analytics and platforms.

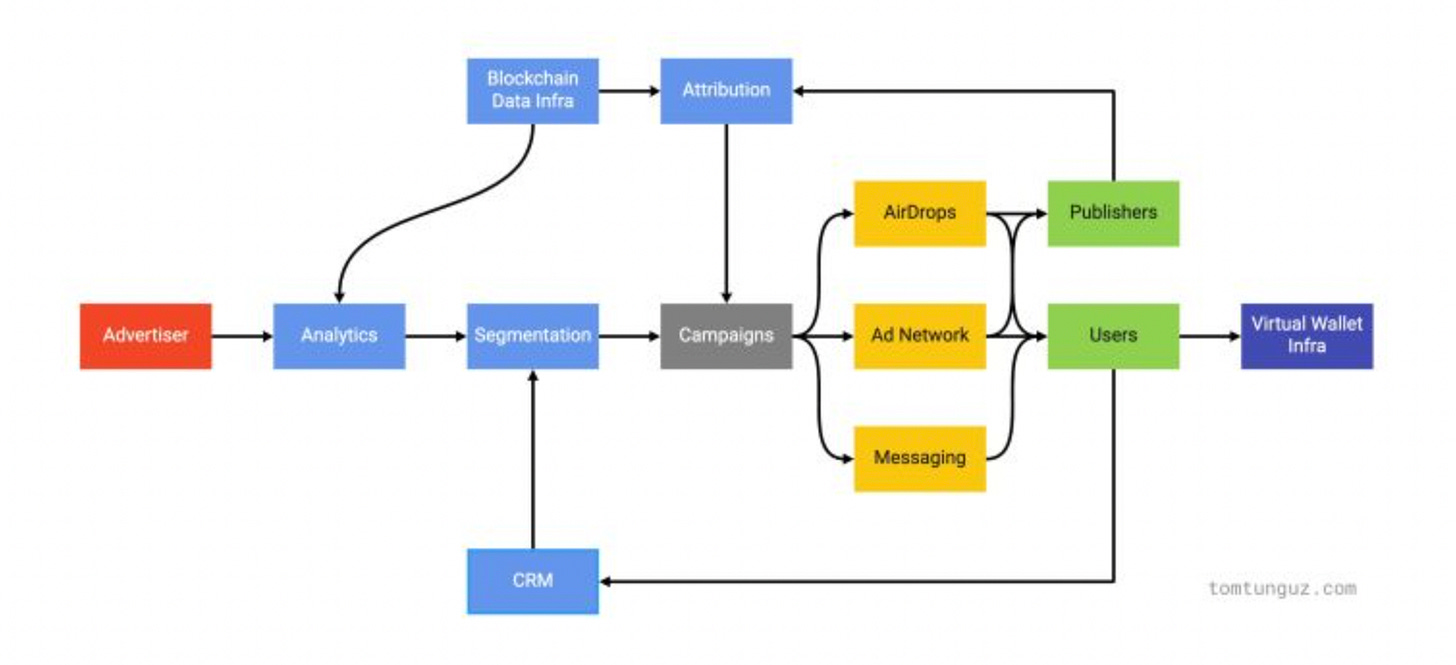

This does not capture the entire picture. Data is flying everywhere - (that would make this image visually unappealing); crypto adds a new layer of data to understand customers.

A web2 brand will have crypto customers and non-crypto customers. Crypto customer data can help brands understand their interests, economic profile, how loyal they are and how active they are with other brands ( POAPS, Airdrops, etc. ).

In addition, a Web2 brand has customers who simply use fiat and engage with the brand in traditional ways ( e-commerce, shops and distribution partners ). This customer data sits nicely in a CDP.

Web3 can help brands capture more first-party data - which we need with the data restrictions highlighted above. While it is anonymized, it is directly connected to a single consumer. The wallet is the conduit to connect with that customer. In some cases, you will be able to attach their behavioural data to an email address, and additional data layers can be added.

Tomasz Tunguz created a helpful data flow map to understand how wallet data, segmentation data, and CRM connect -

The Web3 growth landscape is starting to take shape as addressable audience sizes grow. It is becoming more apparent how you go to market with products and services in this space, even for non-Web3 native businesses.

The latest view on the Web3 growth ecosystem -

If we explore the CRM section within this growth technology landscape - the first thing you will notice is all of the Web3 CRM solutions are focused on communities. Web2 brands do not refer to their email databases as communities - they are simply customers.

Is it possible that Web3 makes everyone feel like they are part of a community? Are they self-selecting into a community at this stage? I think it is both, and this is primarily because most products are small - token holders might be in the 10k or 20k range, so they meet each other and share ideas. While crypto exchanges are large and splash the cash at Superbowl advertising, NFT projects and token memberships tend to be smaller. Project participants also select projects based on the chain, so there might be chain-specific data related to a project ( Solana, etc. ).

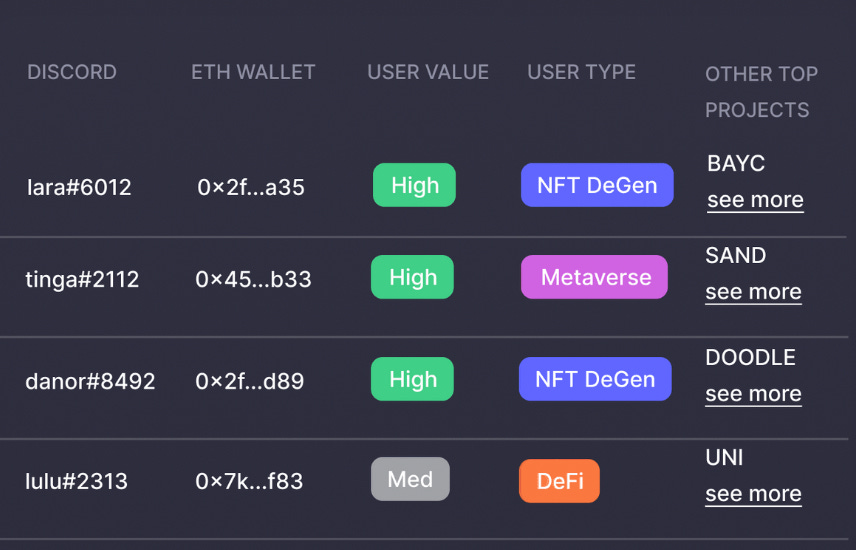

The UI below is the CRM dashboard for KAZM, one of the CRM tools on the ecosystem graphic. You can see the wallet owners’ names ( it might be pseudonymous ), their social media usage, and a descriptor regarding their qualities. As we are still early in the NFT adoption curve, the qualities tend to be related to influence, wealth ( a whale ) and if they are engaging with a project or not. These are all great data points for a Web3 project member database. This is is less useful for a Web2 brand looking to bridge the two.

Tools like Blaze go a step further and help you understand how your onboarding flows work so you can minimize abandonment rates. There are so many best practices emerging when it comes to Web3 community management. Onboarding people into Discord is one of the most common ones. Aspiring token holders get stuck at the Captcha bot ( which seems to be getting more absurd lately ), the token connection process with wallet checks and other steps toward becoming an engaged community member.

Blaze can also show you other projects wallet owners are engaged in. This is a handy marker of status, wealth ( they might have a cold wallet where their ETH is stored ) and their primary interest in the space.

Sesame primarily focuses on gaming CRM - including in-game performance scores and game wallet value. Engaging gamers in a Web3 game is an entirely different challenge, but there are overlapping attributes in this platform compared to the platforms listed above.

Metacommerce claims they are the first relationship management platform for NFT and web3 communities. Metacommerce is a complete ORM (think CRM for wallet owners) with tools tailored to brands and NFT project community needs. This could be to onboard owners, tokenize digital assets, launch a campaign, automate token gating, or release an NFT mint. What makes Metacommerce compelling is that it's a no-code tool making it easy to use.

Absolute labs are the only one that allows brands to add their first-party data ( that we can see anyway ) - so this is an excellent solution for Web2 businesses which are newly engaged in Web3 and want to connect their audiences. This platform is pretty impressive. They consider themselves a Customer Engagement Platform versus CRM. Engagement is commonly used in Web3 since the core strategic focus is community growth and engagement. Absolute Labs has over 250M wallet profiles enabling businesses to engage with waller owners outside their projects and to scan the market faster than using some of the on-chain analytics tools ( Dune, etc. ) where you need code experience to extract data. This platform is reliant on the open web remaining open to offer so much insight. 3RM looks similar to Absolute Labs - they have a credible list of brands using their platform as well. Time is an Absolute Labs client, which speaks volumes.

Other innovative web3 CRM suppliers can take advantage of these shifts in consumer behaviour, especially with the advent of tokenization.

Arianee, the Paris-based platform, recently announced the conclusion of its $21M Series A led by Tiger Global. Arianee’s open-source protocol is used in various industrial sectors by major brands such as Paris Fashion Week, Printemps, Breitling, Groupe Casino, Vacheron Constantin, Panerai and IWC.

Arianee has aimed to reinvent CRM through simple solutions based on the core of Web3 - and the independence of GAFAs. Arianee hopes to reinvent CRM through a fluid and innovative brand experience, allowing consumers to move from digital to physical, harnessing the power of Web3.

A famous company is www.Holder.xyz, launched in June of this year and ****ironically claims to be the first relationship management platform built for NFT projects and web3 communities. The platform leveraged crypto wallet data, social and community insights and first-party data to help web3 businesses better understand their customers. The project launched out of High Alpha venture Studio.

There are 3 components: a wallet data platform, a web3 CRM and a workflow and automation engine to power community building and marketing. They serve any tokenized community, including DAOS, web3 software companies and NFT projects launched from enterprise consumer brands. They work with Pixel Beasts, Woodies, CameoPass and Krause House.

When this article was written - about 50% of the platforms listed on the ecosystem map were either “under construction or in Beta. Very few appear to have significant traction as well.

We’ve seen the hype, the doubt created by crypto winter and the opportunity for brands of the myriad use cases of NFTs. How do new audiences and younger generations interact and create value through Web3? There is not a common consensus on NFTs and how they can be utilized. Brands are standing up for what is THEIR aspect of this new economy and trying to answer the question - what is the revenue vs the data play? Some say this will be a trillion-dollar value, whereas others are still not seeing the value. We DO see the value of NFTs as the new tools of CRM and look at the reverse CRM - where the individual holds the data, as central to the new frontier.

Until next time!

Jen & Lisa